Vehicle insurance is big a part of as a sensible automobile proprietor. Nonetheless, car insurance insurance policies are most often written in the most complicated conditions feasible. This short article can help you to much better know very well what all of the phrases mean. By knowing the relation to the car insurance plan world, you may be a far more well informed consumer.

A great way to save money on the car or truck insurance is to drive your car less often. Most of today’s greatest car insurance businesses offer you discounts to consumers for reduced-miles, incentivizing people to have their automobiles left. Whenever you can walk as an alternative to push, you can get some terrific exercising and save money on your insurance plan.

A great way to save money on the car or truck insurance is to drive your car less often. Most of today’s greatest car insurance businesses offer you discounts to consumers for reduced-miles, incentivizing people to have their automobiles left. Whenever you can walk as an alternative to push, you can get some terrific exercising and save money on your insurance plan.

Upon having a young car owner within your house, your insurance premiums should go up. To save money, invest in a more affordable and less hazardous automobile for the teenage to operate. Don’t surrender if they beg you to get a fancier, sportier car. The less dangerous the automobile, the more affordable the insurance plan.

Go on a class on harmless and defensive driving to economize on your own costs. The greater number of expertise you possess, the less hazardous a motorist you may be. Insurance companies sometimes provide discounts if you take sessions that could make you a more secure motorist. Apart from the cost savings on your own monthly premiums, it’s constantly a great idea to learn to travel safely and securely.

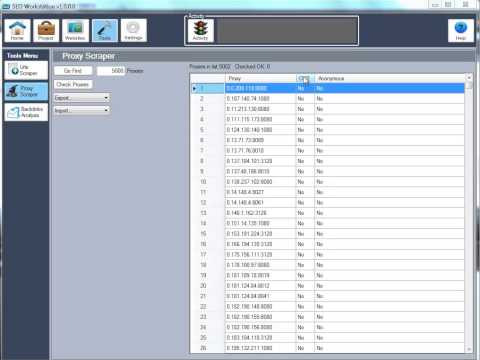

If your car is covered by insurance with multiple car owners and one of these prevents while using vehicle, notify your insurance company immediately. It will be the honest course of action. Should you beloved this post and also you wish to receive details concerning buy dedicated proxy generously pay a visit to our own web site. More importantly, it might lessen your rates considerably oftentimes. Youthful car owners, outdated drivers, and car owners with bad data all boost your top quality. Purchase them taken off your plan as soon as you can.

Despite the fact that it might appear unusual, try to acquire an more aged automobile when looking for a whole new auto. The reason being the insurance plan charges on older autos usually are not practically as much as on more recent ones. If you already have insurance and you also switch to an older motor vehicle, be sure to allow the insurer know.

Do your very best to maintain a good credit rating. A lot of insurance company will appear up your credit history which will effect your top quality. It is possible to improve your credit score by getting out of financial debt and make it by using for a couple charge cards that you just be worthwhile routinely.

To guarantee your boasts will likely be managed quickly, choose best rated insurance providers only. Unidentified insurance firms might offer rates that are low and may seem like a great deal from the short run, but when they attempt to avoid paying out your promises, they are able to cost you over time. Study insurance carriers and make certain to select a single with a decent document.

Reduce your insurance rates by dropping any uneccessary coverage. If you push an old model automobile which is not well worth greater than a couple of thousand dollars, you may drop crash coverage. Accidents insurance coverage pays to repair your automobile, only approximately its replacing benefit, which isn’t much when the car’s only worthy of several lavish. Comprehensive protection functions the same way, and addresses auto damage or injury on account of fire, vandalism or robbery. Examine the price to switch your more mature vehicle with the price to maintain the insurance plan — it is probably not worth it.

Sign-up to get your auto insurance straight from the internet site of the insurer of your respective choosing. Car insurance is frequently less costly whenever you utilize on the web because it fees the company much less to process your data this way. You could get a discount as much as 10 percent by making use of online.

To maintain your auto insurance beneficial and tension-free, ensure you have a minimum of the insurance deductible saved up in a bank account someplace. It doesn’t make a difference how excellent a vehicle driver you will be if someone different reaches you and are generally uninsured. Your insurance policies are there to pay you, however, not for the initial few hundred or so or thousand $ $ $ $.

Get several insurance policies with the same insurance company. Most insurance companies give you a multiple-plan low cost when you have several different types of insurance plans using them. You can get a discount of 10 % to 20 percent simply by having a number of guidelines with similar insurance firm.

A single positive way that can be done to obtain low auto insurance prices is simply by having a excellent driving a vehicle analyze. These driving checks present insurance carriers that you may have used an additional part of risk-free driving a vehicle and that you are more unlikely to get involved in a crash.

If you want to get lower monthly installments on your own car insurance, one important thing that you can do would be to elect to have bare minimum culpability on the auto. This is actually the minimum insurance that is needed legally. The downside to the is that if you receive into any sort of accident the problems will not be bought through your insurance policy.

If you want to get low cost charges on automobile insurance something that you can do to experience this can be by joining an automobile membership. The reason being most groups offer insurance policy on their participants. These clubs have guidelines on who they want to include in their club. Plans might be based on how elegant or unique your vehicle is.

Should you be split in between buying a sportier auto or anything a lot more functional, then keep in mind that both importance, plus the kind of your car, may affect your automobile insurance prices considerably. Sportier autos and vehicles may come with insurance premiums which are 2 or 3 periods beyond their more everyday competitors.

Automobile insurance is needed and regarded as being required by most people. Maybe you have an older vehicle and they are not interested in protecting its replacement in case of an accident. If that is the case, you ought to at the very least have liability insurance, which will safeguard you against pricey lawsuits.

Several car plans are full of perplexing texts. Reading this short article will assist you to obtain a better knowledge of car insurance and help you in making knowledgeable and assured judgements. It is essential to feel safe in the insurance company you selected, and this is possible should you your quest.